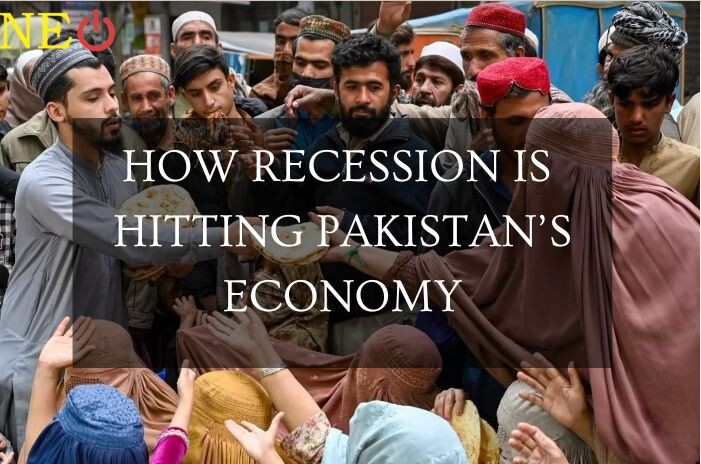

The elements of South Asian international relations is good to go to change before long with Pakistan going the Sri Lanka way, clasping under the obligation tension of China. Numerous different economies in the district are probably going to confront comparable headwinds thinking about the monetary slump on the off chance that the Russia-Ukraine struggle doesn't subside soon. For India, the financial and political emergency in Pakistan is both a test and a valuable chance to prearrange another part in international affairs and geo-financial aspects.

What led to the economic crisis in Pakistan?

On 30 November 2021, Pakistan consented to an arrangement with the Saudi Fund for Development (SFD) to get $3 billion with a plan to further develop its unfamiliar trade reserves.[i] Earlier likewise in 2013, 2016, and 2018, Pakistan looked for outer monetary guide from International Monetary Fund (IMF), UAE, and China to battle its financial crisis.[ii] The ongoing emergency winning in Pakistan is credited to an enormous number of strategy choices that didn't convey expected outcome joined with political turmoil in a few pieces of the country. In this specific situation, this article frames a portion of the vital markers, for example, public obligation, unfamiliar trade save, expansion, and so on, that are liable for the extending financial emergency in Pakistan. This article additionally looks at the reasons that impacted Pakistan to turn to Saudi Arab rather than multilateral offices, for example, IMF, Asian Development Bank (ADB), or some other hotspot for advance.

Why Saudi Arab?

Traditionally, Pakistan and Saudi Arabia have had a very close relationship, particularly based on religious affinity. Both countries are members of Organization of Islamic Cooperation (OIC). Huge volumes of aid for promoting religious activities and supporting humanitarian causes have always flown from Saudi Arabia to Pakistan.[iii] Growing defense cooperation and increasing financial assistance to Pakistan marked the ties between the two countries. Saudi’s Crown Prince Mohammed Bin Salman visited Pakistan in February 2019 with a large business delegation which pledged over USD 20 billion to Saudi investments in Pakistan.[iv] Similarly, Pakistani delegates including Prime Minister Imran Khan have visited Riyadh on multiple occasions. Both nations have always maintained a friendly relationship between them.

Generally, Pakistan and Saudi Arabia have had an exceptionally cozy relationship, especially founded on strict partiality. The two nations are individuals from Organization of Islamic Cooperation (OIC). Colossal volumes of help for advancing strict exercises and supporting philanthropic causes have consistently flown from Saudi Arabia to Pakistan.[iii] Growing guard collaboration and expanding monetary help to Pakistan denoted the ties between the two nations. Saudi's Crown Prince Mohammed Bin Salman visited Pakistan in February 2019 with an enormous business designation which swore over USD 20 billion to Saudi interests in Pakistan.[iv] Similarly, Pakistani representatives including Prime Minister Imran Khan have visited Riyadh on various occasions. The two nations have reliably kept a very much arranged association between them. performance of various pointers Pakistan could scarcely meet the IMF conditions.

Pakistan is additionally faulted for absence of political will to break the hold of strong personal stake gatherings. A new United Nations report proposes that a world class gathering of residents in Pakistan get monetary honors of around $17.4 billion as tax cuts and special admittance to public capital.[vii]

Further, Pakistan's failure to haggle with the IMF reflected in the bombed conversation held in October 2021 and left it with no other option except for to look for help from Saudi Arabia.[viii] Incidentally, conditions connected with its advances from Saudi Arabia is relatively adaptable than the IMF. In any case, the pace of interest charged by Saudi Arabia is a lot higher than the IMFs delicate credit.

Debt obligation to other sources

By June 2021, Pakistan's public outside obligation contacted US$ 86.4 billion enrolling a yearly development of 10.8 percent. This expansion in outer obligation is made sense of by revaluation of misfortunes due for the deterioration of US dollar against other global monetary standards, which swelled the worth of outside obligation in dollar terms. More than one-half of the revaluation misfortunes were because of the enthusiasm for the Special Drawing Rights (SDR) against the US dollar.

The table introduced underneath provides us with an outline of Pakistan's outer obligation liabilities from select sources. Pakistan's outside open obligation is benefited fundamentally from four key sources, with around 49% coming from multilateral offices, 31% from two-sided foundations, 13% from business substances, and 7 percent from Eurobond and Sukuk.[ix]

The reasons of the crisis

The ongoing monetary emergency is principally ascribed to Pakistan's limited strategy choice prompting broad spending on non-formative and financially unviable ventures. Monetary bungle and supporting of purposeless framework projects like Gwadar-Kashgar Railway line project through long haul obligation instruments and depending hugely on outside acquiring instead of from homegrown foundations added to its inconveniences. Carry out of the China-Pakistan Economic Corridor (CPEC) expanded the obligation trouble opening the entryways of the always expanding outside advances. Remarkably, CPEC made a Chinese obligation of US$ 64 billion on Pakistan which was initially esteemed at US$47 billion during 2014.